Bank Negara Malaysia (BNM) on 24 March 2020, announced an automatic 6 months moratorium on all Bank loans starting from 1 April 2020 to assist Borrowers who are facing temporary financial difficulties due to the Covid-19 outbreak.

The deferment relief package allows small and medium enterprises (SMEs) and individuals to delay their loan repayment up to 6 months from 1 April 2020 until 30 September 2020. The deferment includes conventional loans and islamic financing repayment obligations (including mortgage loan, hire purchase loan, personal loan) except for credit card balances.

The moratorium applies to all ringgit-denominated loans that are not in arrears for over 90 days.

How exactly will the deferment change the terms of our current loans? Are we still paying the interest during the deferment period? And the announcement that Banks are waiving compounding interest during the deferment period?

The question is, should individual borrowers such as for housing loans, take the deferment?

I will only touch for mortgage loan and hire purchase loan how it work our under the deferment relief package in this article.

Hire Purchase Loan

Most of us have a car loans with the Banks and they charged a flat interest rate (interest rate is agreed upfront and charged on a fixed amount) throughout the entire tenure. There will be NO additional interest charged during 6 months deferment period as the interest follows flat rate basis so the principal sum does not increase, which means we will enjoy a “Payment Holiday” with no implications start 1 April 2020 until 30 September 2020.

*It is applicable to flat rate car loan only. For variable rate car loans, the calculations will be followed a reducing balance interest charge – please refer to the mortgage explanation below.

Mortgage Loan/Home Loan

Do you know that your mortgage or home loans mostly charge interest on a reducing balance basis and the interest is charged each month based on the total outstanding balance from the previous month. With 6 months deferment relief package, BNM and all Banks mentioned that all borrowers do not need to pay anything during this period – BUT do you know that your interest still running. Have checked all Bank’s as well as BNM’s FAQ on this, confirmed that the interest will accrue during this period.

Don’t forget if you got outstanding month before the deferment period start 1st April 2020, the Banks will chase and need you to settle the outstanding month as you paying this period from 1 April 2020 until 30 September 2020. Same to car loan as well. Please check with your current Bank if you have outstanding month.

What about the non-compounding interest? As all Malaysian Banks have announced that they will not be compounding interest for the accumulated interest during the 6 months deferment period. Great to hear that and you no need to worry about this.

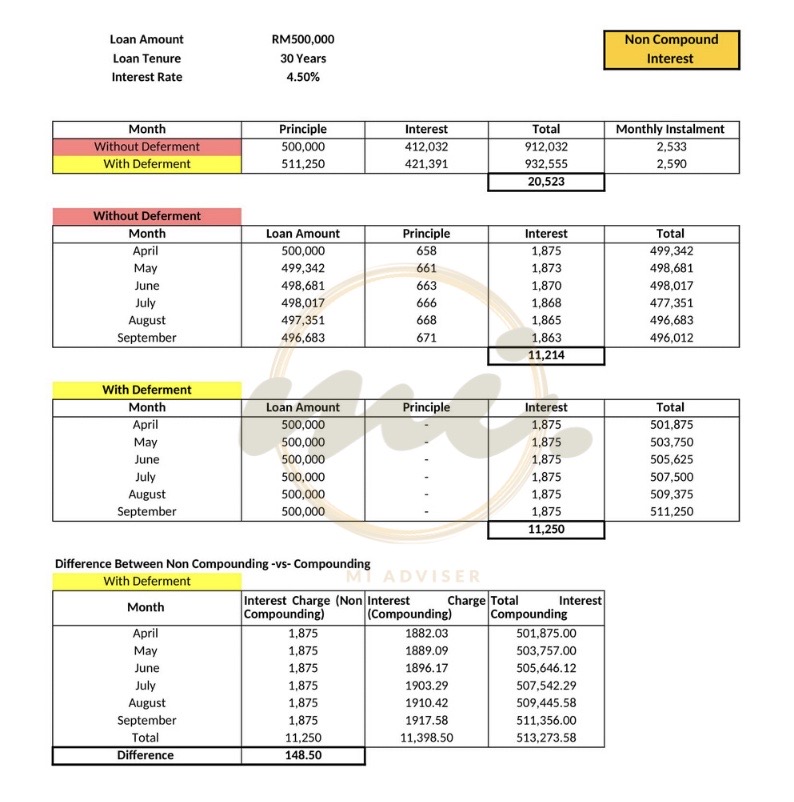

Below the example to show overall impact to your Loan With or Without Deferment under the Deferment Programme

As you can see, the different between the loan with or without deferment programme (from my view side).

Not a “Premium Holiday”, however, borrowers must keep in mid that the loan interest will be continue to accrue during the period of the moratorium. Loan repayments will be resumed after the deferment period and interests would be continue to be charged on the outstanding balance comprising both principal and the interest portion (compounded/non-compounded) during the deferment period.

What is the alternative repayment option after the deferment programme?

The Banks will offer the options to repay this amount:

![]() Pay the accrued interest in one lump sum coming October 2020 in addition to your usual monthly repayment and then your loan tenure and repayment remains unchanged.

Pay the accrued interest in one lump sum coming October 2020 in addition to your usual monthly repayment and then your loan tenure and repayment remains unchanged.

![]() Pay the same monthly repayment amount coming October 2020 onwards but the loan tenure will be extended to accommodate the additional interest payment.

Pay the same monthly repayment amount coming October 2020 onwards but the loan tenure will be extended to accommodate the additional interest payment.

![]() Pay a higher monthly repayment coming October onwards to accommodate the additional interest payment but the loan tenure will not changed.

Pay a higher monthly repayment coming October onwards to accommodate the additional interest payment but the loan tenure will not changed.

Please check with your current Bank see what are the options they will offer to you as above only the most common ones offered by Banks.

For Islamic Home Financing

You can ignore the above as the profit will continue to accrue on the outstanding principal amount. Such profit however, will not be compounded in line with Shariah principles.

But in tough times like this, liquidity comes first. Individuals could cancel anytime the deferment relief package even before 6 months once market conditions get better.

As you know government aim is reducing the financial burden on the rakyat and this is to remind borrowers that the deferment relief package does not mean you now have “free money” to spend. You need to evaluate you own financial condition whether you want to take this deferment package or not.

One of the good things about this loan deferment is that individuals have the option whether to take it or not. If you choose to do so, you must understand that there will be a cost, especially if interest is compounded (*most of the Banks waive compounding interest).

Conclusion, borrowers must take initiative to find our from your current Banks what they are in for the post-moratorium period to ensure you can meet your financial obligations then.

![]() Who is eligible for the deferment package?

Who is eligible for the deferment package?

![]() All individual loans or financing are eligible excluding credit cards and loans that have more than 90 days in arrears and foreign currency denominated loans.

All individual loans or financing are eligible excluding credit cards and loans that have more than 90 days in arrears and foreign currency denominated loans.

![]() Do I need to call the Bank to apply?

Do I need to call the Bank to apply?

![]() No. All individual loans or financing (excluding credit cards) that meet the criteria will automatically qualify for the deferment.

No. All individual loans or financing (excluding credit cards) that meet the criteria will automatically qualify for the deferment.

![]() Can I ask for more than 6 months deferment after the deferment period over?

Can I ask for more than 6 months deferment after the deferment period over?

![]() The deferment is only limited for 6 months period. It is better for individuals to contact your current Banks to make special arrangements if you require a deferment of more than 6 months.

The deferment is only limited for 6 months period. It is better for individuals to contact your current Banks to make special arrangements if you require a deferment of more than 6 months.

![]() Will my CCRIS record will be affected if I accept the deferment package?

Will my CCRIS record will be affected if I accept the deferment package?

![]() No. However, interest or profit will continue to accrue on loan or financing repayments that are deferred.

No. However, interest or profit will continue to accrue on loan or financing repayments that are deferred.

![]() Which Banks offer this deferment package?

Which Banks offer this deferment package?

![]() All licenced Bank, licenced Islamic Bank and prescribed development financial institutions regulated by BNM will offer this deferment flexibility.

All licenced Bank, licenced Islamic Bank and prescribed development financial institutions regulated by BNM will offer this deferment flexibility.

![]() My loan repayment is being automatically deducted from my salary, am I still eligible for the deferment package?

My loan repayment is being automatically deducted from my salary, am I still eligible for the deferment package?

![]() Yes. Please inform your Company or Bank to stop the salary deduction if you choose for this deferment package.

Yes. Please inform your Company or Bank to stop the salary deduction if you choose for this deferment package.

![]() I have a few loans but I only want the repayment deferred for a certain loan, what should I do?

I have a few loans but I only want the repayment deferred for a certain loan, what should I do?

![]() Please contact your Bank and inform them about the account that you would like to be excluded from the automatic moratorium.

Please contact your Bank and inform them about the account that you would like to be excluded from the automatic moratorium.

![]() Does this deferment package include new approved or disbursed loan?

Does this deferment package include new approved or disbursed loan?

![]() Yes. It applies to all loans or financing outstanding as at 1 April 2020.

Yes. It applies to all loans or financing outstanding as at 1 April 2020.