Unit Trust Investment

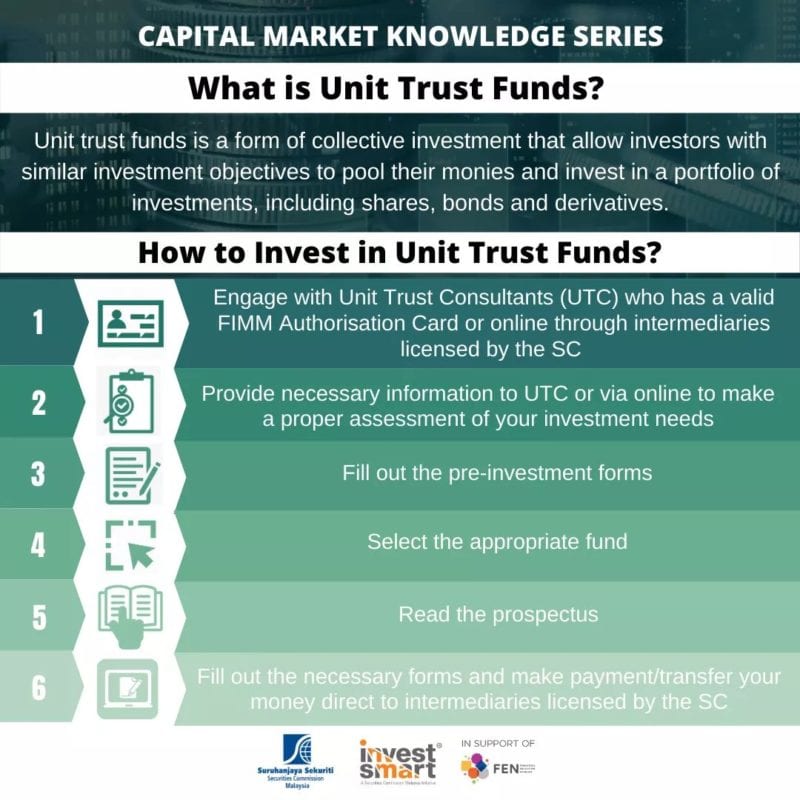

How to Invest in Unit Trust Fund

There are generally 3 ways to invest in unit trusts funds, namely through Cash, Regular Savings or Investment through your EPF fund.

Cash or Lump Sum Investments

This is where an investor has a lump sum amount to invest into a unit trust fund. Over a period of time, the initial investment will increase as income is earned by the fund. When the investor redeems his or her units, the unit redemption price will reflect the accumulation and compounding of the invested capital over the relevant periods. It is this compounding effect over time which makes investment into unit trust funds attractive.

Regular Savings

An investor may invest in unit trusts funds by making regular (e.g. monthly or quarterly) investments to their fund. This is an ideal, disciplined and useful way to generate capital for a future need. By making equal and regular contributions over a period of time, the sum accumulated at the end of the period will increase. This is commonly known as dollar cost averaging. At the end of the period, the redemption (or sale) price of the units held will represent the accumulation of all contributions, plus returns generated from the total contributions since the first purchase was made. The effect is more noticeable the longer the holding and contribution period. This form of savings is the basis of most pensions fund accumulation e.g. the Employees Provident Fund.

EPF Members Investment Scheme

Investors may also invest into unit trust funds from their EPF Account 1 if he or she is eligible. EPF members can refer to their EPF statement as well as the Basic Savings Table to check their eligibility and quantum of investment allowed.