Common misconceptions about Takaful

What is the unique of Takaful

Takaful is open to everyone, and one does not have to be Muslim to take on Takaful coverage or to be a Takaful agent. Lack of awareness may be the reason behind why people think Takaful is only meant for Muslims when in fact Takaful is broad and borderless . So people need to know that they are other types of coverage they can explore aside from conventional insurance coverage.

Takaful is fundamentally different from conventional insurance

The idea of Takaful is similar to conventional insurance and shares the same fundamental roots. Both Takaful and conventional insurance aim to provide individuals as well as corporate bodies from loss and hazards. There is a common objective of both Takaful and conventional insurance which is an aim to reduce financial burden that arises in the event of disasters or loss.

Takaful is invested in the concept of mutual sharing, ethical means and to provide financial protection to all those in need, Takaful is unique compared to conventional insurance.

The Takaful industry in Malaysia started to gain momentum when, in October 1982, the Malaysian government formed a special task force to explore the viability of setting up an Islamic insurance company. Launched in 1984, mostly Malaysians today choose conventional insurance than takaful.

Getting your family and yourself covered by insurance/takaful schemes has become a must-do today. There are many people mostly non-muslim they do not aware or some will hear about Takaful too. On their mindset, they think Takaful is only for muslim to own/having it.

What you should know about Takaful Security?

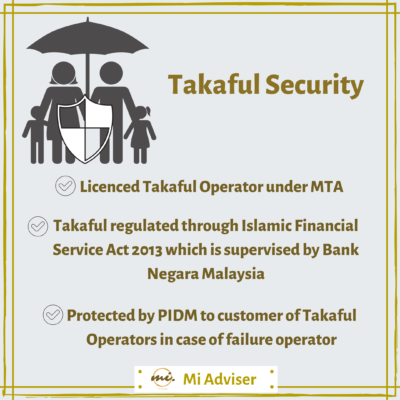

The lack of awareness about some key facts that may have contributed to the misconception that Takaful is less secure than conventional insurance. Some of these facts are:

Takaful being regulated through the Islamic Financial Service Act 2013, supervised by Bank Negara Malaysia and the Governor of the Bank holding the regulatory responsibility, is would be safe to say that Takaful is secure, safe and reliable for Malaysians to invest in.

Further, just like conventional insurance policy holders, Takaful certificate owners will also be protected by PIDM under the Takaful & Insurance Benefits Protection System (TIPS). Established by the government, TIPS include PIDM member institutions and should both of they fail, PIDM will protect you against the loss and provide you security.

As a potential Takaful certificate owner, it is your duty to make sure the service provider you are looking the licenced Takaful Operator Malaysian Takaful Association (MTA) to ensure you are choosing the right Takaful operator and will be rightfully protected in case of emergencies.

![]() What so unique about Takaful Ikhlas Family Berhad?

What so unique about Takaful Ikhlas Family Berhad?

Takaful IKHLAS is principally involved in the provision of Financial protection services, based on principles and rulings of fully Shariah-compliant accordance with the legislative requirement under the Islamic Financial Services Act, 2013 (IFSA). Takaful IKHLAS offers a comprehensive range of family products are:

Family Takaful

Provides both protection policy and long term savings for you and your beneficiary.

Investment-Linked Takaful

Family Takaful that is combines investment with Takaful cover. Investment will be in Shariah approved investment funds.

Medical & Health Takaful

Gives coverage for the cost of private hospital medical treatment and hospitalization.

Child Education Takaful

This will provide your child financial protection should you suffer from disaster such as permanent disability or death. At the same time, this Takaful product also offers long-term savings for your child’s higher education expenses.

This misconception occurs mostly due to the name ‘Takaful’ and the origin of this protection system which is related to Islam. Many non-Muslims wrongly connect the dots and misunderstand that Takaful is religion-based and hence, is not for non-Muslims.

On the other meaning, Takaful advocates the concept of ethical protection and promotes brotherhood as per the Islamic teachings, it is not a religious product.

Non-Muslims can explore this financial tool and all those who believe the ethical elements behind Takaful will find what they need with Takaful.

Takaful is open for anyone globally to pay contributions and be a part of Takaful. Anyone despite their race, religion, background and creed can explore and gain from Takaful.

To find out about the Takaful Ikhlas Family’s Products, please click here.

Please read the related Blog Takaful -vs- Insurance